1.2 billion cups a year! Zhejiang-made milk tea Gu Ming sprints to Hong Kong stocks. Why does small milk tea drink a big industry?

More than ten years ago, in Daxi Town, Wenling, Taizhou, a small town in Zhejiang, Wang Yunan, a science and engineering man who graduated from university, opened a tea shop called Guming, which was rarely visited when it first opened. No one would have thought that Gu Ming would become the "Bai Yueguang" of Zhejiang young people in the future, and become a giant of domestic tea making.

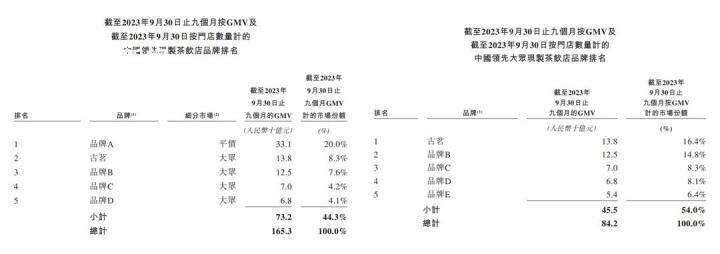

At the beginning of 2024, Gu Ming and Mi Xue Ice City submitted a prospectus to the Hong Kong Stock Exchange on the same day. According to the prospectus, in 2023, Guming sold 1.2 billion cups of drinks, the merchandise sales exceeded 19.2 billion yuan, and the number of stores reached 9,001. It is the largest brand of ready-made tea shops of Volkswagen (10-20 yuan price band) in China, and the second largest brand of ready-made tea shops at full price.

According to the prospectus of Guming Tea, it has become the second largest brand of ready-made tea shop at full price.

Zhejiang, with its mountains and waters, has never lacked enterprises that create myths in the "drinking" industry. Wahaha and Nongfu Spring have long been household names. In recent years, various brands of online celebrity milk tea have appeared in the hot tea-making industry, and stores can be seen everywhere, which is quite favored by the capital market. To paraphrase a network, milk tea is not big, and it creates a myth. Zhejiang-made milk tea has occupied an important seat.

In a cup of sweet milk tea, Zhejiang enterprises have almost witnessed the iterative changes of the industry. How far has Zhejiang’s milk tea gone? How can a small cup of milk tea "drink" a big industry? Facing the new consumption environment, how will it continue to be a good thing for young people?

Zhejiang Jianghu with milk tea

Photo by Yang Yifan, a reporter from an ancient store on Jianguo North Road in Hangzhou.

On the west side of Jianguo North Road in Hangzhou, several tea shops are open next to each other. Young people at the door of the store scanned the code to place an order, and the takeaway brother who came to pick up the meal rushed to urge the clerk to pack quickly. Such a scene can be seen in many cities across the country.

When Wang Yunan opened the first "Guming Tea" in Daxi Town, the business was not good at first. Every day, he was busy from 8 am to 11 pm, and the turnover of Guming Tea was only in 400 yuan on average one day. After deducting the rent and other expenses, he still lost money, which lasted for half a year.

During his college years, Wang Yunan sold radios, quilts and credit cards for his classmates, and gained hundreds of thousands of working capital. After graduation, he returned to his hometown to start a business. He felt that the investment cost of opening a tea shop was low and he liked to drink it. There were also great business opportunities in small places. Without the formula, Wang Yunan kept drinking milk tea to debug the product. Through continuous improvement, the business gradually improved, which made the young man have a greater vision for this career. Perhaps influenced by this experience, Wang Yunan is extremely concerned about the taste and details of the products, and he will try every new product of Guming before it goes on the market.

At that time, another Zhejiang enterprise had made a name for itself by relying on milk tea, and took the top spot in the domestic market. In 2005, Xiangpiaopiao, born in Huzhou, created the category of Chinese cup milk tea. Nowadays, mentioning its name can be described as a lot of childhood "memory killing" after 90.

Fragrant milk tea Image source: Fragrant official website

According to official website, by 2008, the sales volume had exceeded 1 billion. In 2017, it successfully landed on the Shanghai Stock Exchange. With the portable cup-brewed milk tea, the market share ranked first for nine consecutive years. In the brewing milk tea market, "Xiangyue milk tea" in Wenzhou, Zhejiang Province has also made great efforts in the market, and cup-packed and bagged milk tea has entered supermarkets and shops in many places.

In terms of bottled milk tea, Zhejiang enterprises Wahaha and Nongfu Spring have also launched corresponding products. For example, in 2021, Nongfu Spring launched a series of "milk tea" products, which played a differentiated advantage in the highly competitive bottled milk tea market. On social media, the product has won praise for its taste. In double 11, which has just been listed for one month, it sold tens of thousands of boxes.

Nongfu Spring’s "Playing Milk Tea" Image Source: Nongfu Spring official website

With the further development of milk tea market, fresh-made tea has become a new track.

Gu Ming opened the second direct store in 2011, and the first franchise store in April of the same year, which started the chain operation mode. In order to help inexperienced franchisees choose a location, Wang Yun An once spent three months driving with each other to choose a location. Lack of start-up funds, and even borrow money to help franchisees tide over the difficulties. First, understand a regional market thoroughly, and then break it down one by one by means of "mentoring". In Zhejiang Province, where Gu Ming made his fortune, the number of stores has exceeded 2,000, accounting for more than 20% of the total number of stores.

Some analysts pointed out that Gu Ming has unique conditions: he was born in Zhejiang, where there are bold and cautious small bosses everywhere, and he is well-informed in joining and doing business; In terms of per capita consumption power, Zhejiang people are also in the forefront.

For more than ten years, Zhejiang milk tea enterprises have witnessed the changes in the rivers and lakes of milk tea. According to Zhu Danpeng, a food industry analyst in China, the change of milk tea products is not only the promotion of overall consumption upgrade, but also the concrete manifestation of competition in the whole industry. With the new generation of consumer thinking and consumer behavior changes, it is also forcing the entire industry to continue to innovate, upgrade and iterate.

Milk tea "drinks" a big industry

Xiao Zhou, who worked in Hangzhou for several years after 1995, is one of the fans of milk tea, and she is willing to try all kinds of milk tea. After lunch, she always spells orders with her office colleagues. Although it takes a long time to meet the peak order period, in her opinion, "the price of a cup of milk tea is not high and all kinds of new products are very attractive". Gu Ming’s super A cheese grapes are regarded by her as the source of happiness in summer. This ancient tea is one of the best-selling drinks. From 2021 to the first three quarters of 2023, the total sales volume exceeded 130 million cups.

A group of young people like Xiao Zhou have become loyal consumers of ancient tea. According to the prospectus, by the end of 2023, the number of registered members of Guming applet was about 94 million. Among them, the number of quarterly active members in the fourth quarter of 2023 exceeded 36 million, and the average quarterly repurchase rate in 2023 reached 53%.

"Super A Cheese Grape", one of Guming’s best-selling products. Image source: Guming official website

According to the consulting report, the mass ready-made tea shop market is the largest and fastest growing market segment in China. The GMV of China Volkswagen ready-made tea shop market reached RMB 86.5 billion in 2022, and is expected to further increase to RMB 244.4 billion in 2027, with a compound annual growth rate of 23.1%.

Why does a cup of milk tea make a big industry?

Xiao Liang, director of the Modern Business Research Center of Zhejiang Gongshang University, said in an interview with Chao News that milk tea has the characteristics of high-frequency consumption, high user stickiness, low entry threshold and strong IP rotation. The new tea industry represented by milk tea can explode and drive the development of the industry, which stems from its multiple consumption values.

First of all, it is emotional value. In addition to drinking this functional value, milk tea with a relatively sweet taste can relieve stress and satisfy self for many young people. According to the Report on the Investigation and Analysis of the Development Status and Consumption Trend of China’s New Tea Industry in the First Half of 2022 by Ai Media Consulting, "Trying new drinks", "relieving pressure" and "good taste" are the first three factors that make consumers increase their purchase intention.

Secondly, it is social value. "Milk tea is becoming a social way for young people", and behind the explosion of some tea brands in online celebrity and the "first cup of milk tea in autumn" becoming a hot word on the Internet, there are certain social consumption motives.

Moreover, the unit price of milk tea products is relatively low. You can get a taste bud satisfaction with little money and have both emotional and social values, so you can get the favor of young people who are paying more and more attention to cost performance and pursuing quality and product style.

The development of new tea enterprises also conforms to the changes of consumption habits and consumption environment.

Jiang Han, a senior researcher at Pangu Think Tank, said that with the popularity of the mobile Internet and the rise of e-commerce, consumers can buy milk tea online anytime and anywhere, which is convenient for consumers to buy. As people pay more and more attention to the quality and taste of products, they are more inclined to choose healthy and fresh food. In addition, people pay more and more attention to the consumer experience, and their loyalty to the brand is getting higher and higher. Judging from the prospectus, Guming pays attention to brand building and quality assurance, focusing on the mid-to high-end market and adopting the strategy of high quality and high price. "The new tea meets the needs of consumers for quality, taste and consumption experience, and it can achieve such great success in the market."

Where are the "ancient teas" going next?

A pair of black-rimmed glasses, a sweater, and a backpack, everyone grinned humbly. Wang Yunan, who is full of science and technology, said in an interview with the media that he would try to make milk tea bigger and better. Now he is getting closer and closer to his original dream. With the supply chain and R&D capabilities, product innovation capabilities, and a win-win situation with franchisees, Guming is rushing to compete in the second half of milk tea.

The staff of Guyumen Store are making drinks. Photo by reporter Yang Yifan.

In Jiang Han’s view, Gu Ming and Mi Xue Bing Cheng rushed to IPO, and the rapidly developing tea industry attracted the attention of the capital market. Judging from the prospectus, the two business and profit models have their own characteristics. Guming pays attention to brand building and quality assurance, focusing on the middle and high-end market and adopting the strategy of high quality and high price; While Mi Xue Bing Cheng pays attention to cost control and large-scale development, focusing on the mass market and adopting the strategy of small profits but quick turnover. Although each has its own characteristics, the future milk tea market will have huge space, but the competition will be extremely fierce.

"The whole new Chinese milk tea has entered a very involuted node, and it has also entered a cycle of big waves and sands. The Matthew effect of the stronger and the weaker is highlighted." Zhu Danpeng said that the listing of tea companies, with the empowerment of capital, will undoubtedly further accelerate the integrity of the supply chain and expand stores.

In Gu Ming’s view, more than 500 stores in a single province are the key scale. At present, it has established a network of stores exceeding the key scale in eight provinces including Zhejiang. Wang Yun ‘an said in an interview before that the expansion of Gumingmen Store follows the supply chain, that is, where the warehouse is built, Gumingmen Store will open. In addition, Guming will also enter more markets such as Hong Kong and Macao. In the prospectus, Gu Ming said that he would continue to invest in strengthening supply chain capabilities, expanding store networks, investing in product research and development, brand building and user operations, and maintaining further growth.

Sinking the market is becoming the direction for "milk tea people" to seek new growth. Zhu Danpeng believes that with the continuous acceleration of urbanization, the overall consumption willingness, consumption confidence and consumption power of young people in small towns are still good. "The sinking market is the top priority and development direction of the entire FMCG industry in the next two years." According to the consulting report, the market of mass ready-made tea shops, second-tier and below cities are expected to develop with the fastest growth rate from 2022 to 2027, and contribute most of the market increment.

Known as the "Snow King", Honey Snow Ice City takes the ultimate cost-effective route and has 36,000 stores, which has strong strength, scale effect and fan effect in the sinking market. Gu Ming, who came out of a small town in Zhejiang, is emphasizing its advantage in sinking the market. As of December 31, 2023, the number of stores in Guming in second-tier cities and below accounted for 79% of the total number of stores. At the same time, 38% of the stores were located in towns and villages far from the city center. The above two proportions are the highest among the top five brands of public ready-made tea shops in China according to the number of stores.

How will the "involuted" milk tea industry continue to be a good thing for young people? Jiang Han believes that in the future, tea companies will undoubtedly continue to work hard in terms of quality, taste, brand and service, form their own characteristics and advantages, and constantly innovate and upgrade, innovate marketing methods and introduce new products to meet the changing needs of consumers.

The fierceness of a cup of milk tea and the growth and fierce competition of the industry also reflect the consumption changes of young people at present in a rather critical way. "Especially after the epidemic, consumption tends to be rational. For young people, they are more willing to spend money on small items with low prices than buying big ones, and the proportion of such consumption may increase. The development of more industries should pay attention to and adapt to such trends. " Xiao Liang said.